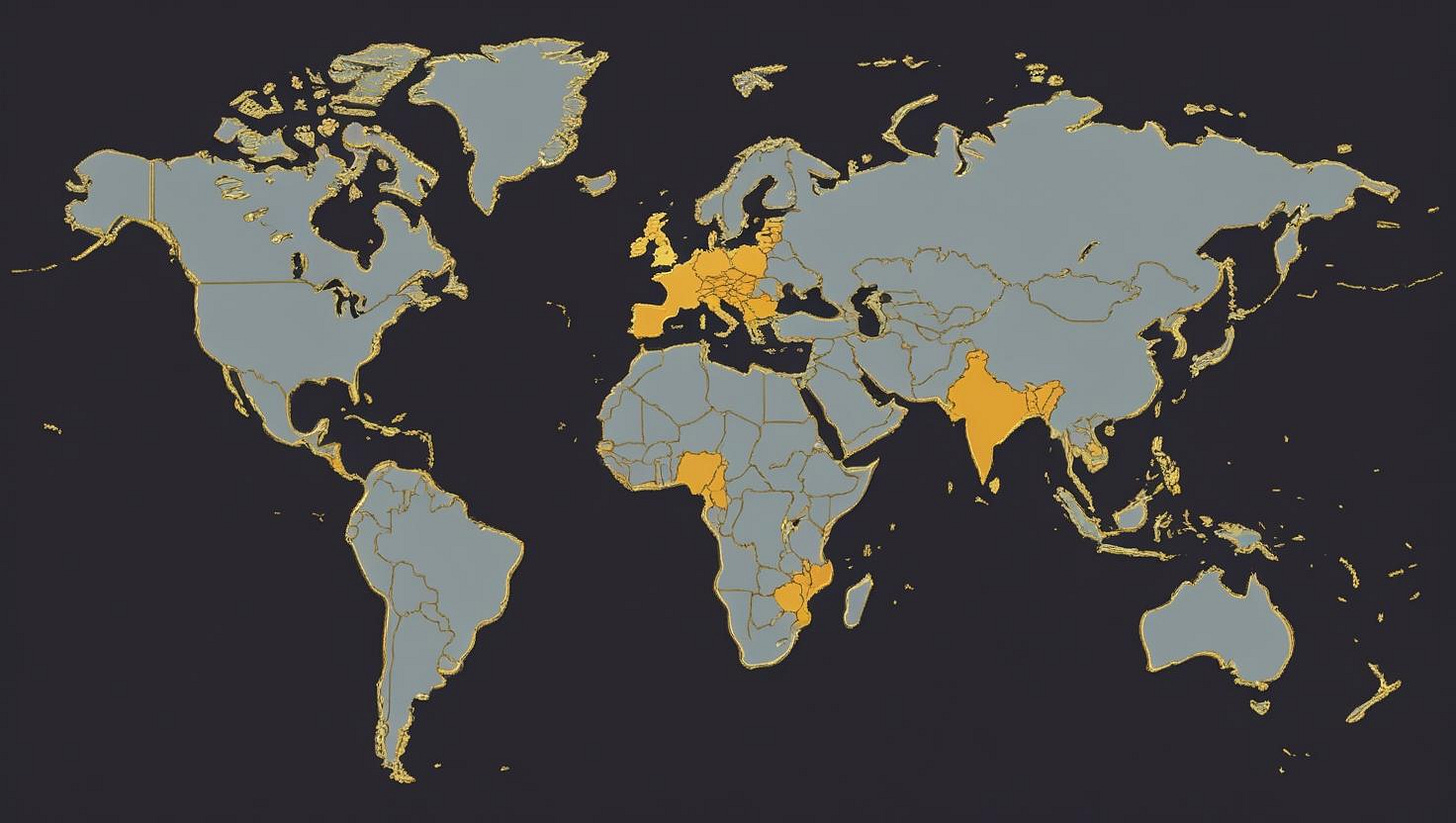

7 Countries Using Stablecoins to Quietly Exit the Dollar.

Research Drop — July 2025 | Deep Brief.

While headlines obsess over the Fed, ETFs, and CPI prints, a quieter but more powerful shift is underway:

Countries are exiting the U.S. dollar — not with announcements, but with infrastructure.

They're not replacing the dollar overnight.

They're routing around it — through stablecoins.

The following 7 nations are using crypto-backed dollars to bypass capital controls, navigate sanctions, hedge currency collapse, or settle international trade. And they’re doing it with quiet intent.

Let’s Deep Brief who’s moving, how, and why.

1. Argentina – From Peso Collapse to Parallel Dollar System

After the government's June 2025 decision to scrap the peso peg (again), inflation surged past 160%.

As banks ration USD access and trust in the peso evaporates, Argentines have embraced USDT as a shadow reserve currency. On-chain volume is up 74% QoQ, with major cities now informally pricing goods in stablecoins.

Stablecoins are no longer an asset class here — they’re a functional economy.

2. Nigeria – Bypassing Banking With Stable Crypto Dollars

Nigeria’s central bank has restricted FX access for years. In response, individuals and SMEs are using P2P USDT transfers to move funds, settle imports, and even pay salaries.

Despite regulatory pressure, adoption continues through WhatsApp groups, Telegram OTC markets, and cross-border fintech rails like Binance Pay.

USDT = dollars without the gatekeepers.

Result? A stablecoin-powered shadow economy.

3. Turkey – Wealth Preservation by Any Means

With persistent inflation and lira depreciation, Turkish citizens and businesses are parking value in USDT, USDC, and gold-backed tokens.

While domestic banks tighten restrictions, stablecoins offer escape routes — legally gray, but functionally critical.

Watch for further growth in gold-pegged stablecoins as a culturally-aligned hedge.

4. Russia – Sanction Workarounds + Petrosettlement Experiments

Officially banned from most SWIFT channels, Russia has ramped up its use of stablecoins and tokenized assets for cross-border trade.

Oil contracts are quietly being settled using FDUSD and Tether Gold (XAUT) via intermediaries. Russia also launched a BRICS-aligned digital commodity settlement layer in Q2 2025.

This isn’t de-dollarization by decree.

It’s stablecoin-enabled financial shadow routing.

5. Lebanon – Banking Collapse → Crypto Rails

After years of currency collapse and banking failure, Lebanon now has one of the highest crypto usage rates per capita in MENA.

Stablecoins, primarily USDT on Tron and Ethereum, are used daily for:

Freelance income

Import/export

P2P remittances

Banks failed. The dollar is scarce. Stablecoins filled the void.

6. Venezuela – Old Crisis, New Tools

Crypto has been a survival tool in Venezuela for years, but in 2025, stablecoin adoption is institutionalizing.

Small businesses and NGOs now use platforms that convert stablecoins into bolívars at the point of sale. Families transact over Telegram and mobile apps — no banking required.

The Petro failed.

Stablecoins are the real “digital currency of the people.”

7. Kenya – Mobile + Stable = Leapfrog Effect

Kenya’s M-Pesa mobile money system paved the way for fast fintech adoption. Now, stablecoins are quietly integrating into that layer.

Young Kenyans use USDC and USDT for savings, remittances, and even staking yield via DeFi protocols.

Mobile-first + crypto-native = the fastest on-ramp to stablecoin adoption in Africa.

🧠 Final Insight: Dollar Exit Isn’t Loud — It’s Leaking Quietly

These countries aren’t waving flags and announcing “de-dollarization.”

Instead, they’re replacing USD rails with stablecoin rails. Same currency — different control layer.

For the U.S., this may be more dangerous than outright abandonment.

It’s not the dollar they’re rejecting — it’s the system that governs it.

The exit won’t be televised.

It’ll be transacted over-chain.

— Deep Brief